All 30 Dow Jones Stocks Ranked: The Pros Weigh In

The Dow Jones Industrial Average comprises 30 blue-chip stocks that are tops in their industries. But some Dow Jones stocks are better buys than others.

You can't beat Dow Jones stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market.

Case in point: the S&P 500 gained 24% on a price basis last year, while the tech-heavy Nasdaq Composite, which is both riskier and "growthier," rose 43%. The Dow Jones Industrial Average, by comparison, very much lagged the pack. The elite bastion of 30 mostly mature industry leaders delivered a comparatively poky gain of 14%

To be sure, that's a very good year on an absolute basis: the Dow's annualized total return over the past three decades comes to a bit more than 10% before inflation. And yet the fact remains that the Dow lagged the S&P 500 and Nasdaq by painfully wide margins this year.

Zoom out, however, and Dow Jones stocks have served buy-and-hold investors quite well since the market hit its previous all-time closing high back on January 3, 2022. On a total return basis (price change plus dividends), the Nasdaq is up 2.9% and the S&P 500 is up 9.9%.

The Dow, however, generated a total return of 12% over the same span.

It's also important to know that the Dow's recent underperformance isn't abnormal. More than half of the average's components are low-beta stocks. That means they tend to lag in up markets, but hold up better when everything is selling off. This low-beta skew can actually be quite advantageous to long-term investors.

After all, as bright a year as it's been for equity investors, downside risks very much remain. Economists still put the odds of recession hitting in the next year at 40%. Meanwhile, the New York Federal Reserve's yield-curve model calculates recession odds at greater than 60%.

Should such a change in market fortunes come to pass... Well, that's where Dow Jones stocks come in.

Dow Jones stocks ranked

This collection of industry-leading companies and dividend growth stalwarts with their impregnable balance sheets can offer relative stability in tempestuous market times. From the best Dow dividend stocks to the most widely held blue chip stocks, components of the industrial average occupy top spots in the portfolios of hedge funds and billionaire investors. Warren Buffett's Berkshire Hathaway (BRK.B), in particular, is a huge fan of select Dow stocks.

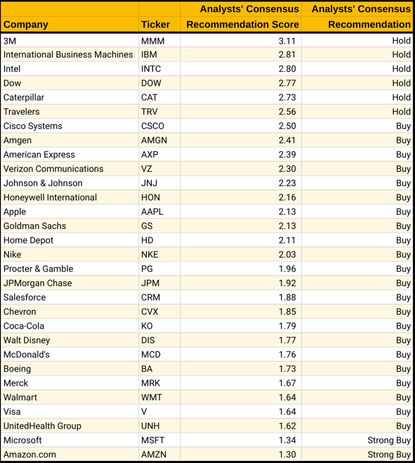

To get a sense of which Dow Jones stocks Wall Street recommends at an increasingly uncertain time for equities, we screened the DJIA by analysts' consensus recommendations, from worst to first, using data from S&P Global Market Intelligence.

Here's how the ratings system works: S&P surveys analysts' stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Scores between 3.5 and 2.5 translate into Hold recommendations. Scores higher than 3.5 equate to Sell ratings, while scores equal to or below 2.5 mean that analysts, on average, rate shares at Buy. The closer a score gets to 1.0, the higher conviction the Buy recommendation.

Note that Amazon.com (AMZN) was added to the Dow as of February 26, replacing Walgreens Boots Alliance (WBA).

See the table below for analysts' consensus recommendations on all 30 Dow Jones stocks, per S&P Global Market Intelligence, as of February 25, 2024.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade stocks or other securities. Rather, he dollar-cost averages into cheap funds and index funds and holds them forever in tax-advantaged accounts.

-

Charitable Remainder Trust: The Stretch IRA Alternative

Charitable Remainder Trust: The Stretch IRA AlternativeThe SECURE Act killed the stretch IRA, but a properly constructed charitable remainder trust can deliver similar benefits, with some caveats.

By Brandon Mather, CFP®, CEPA, ChFEBC® Published

-

Three Ways to Take Control of Your Money During Financial Literacy Month

Three Ways to Take Control of Your Money During Financial Literacy MonthBudgeting, building an emergency fund and taking advantage of a multitude of workplace benefits can get you on track and keep you there.

By Craig Rubino Published

-

Stock Market Today: Stocks Stabilize After Powell's Rate-Cut Warning

Stock Market Today: Stocks Stabilize After Powell's Rate-Cut WarningThe main indexes temporarily tumbled after Fed Chair Powell said interest rates could stay higher for longer.

By Karee Venema Published

-

Why Is UNH Stock Soaring After Earnings?

Why Is UNH Stock Soaring After Earnings?UnitedHealth beat expectations for the first quarter, sending UNH stock up over 5%. Here's what you need to know.

By Joey Solitro Published

-

What Is Proxy Season and Should You Vote?

What Is Proxy Season and Should You Vote?Proxy season is upon us, allowing investors to weigh in on corporate leadership and policies. Here, we look at proxy season and whether you should vote.

By Kyle Woodley Published

-

Stock Market Today: Stocks Reverse Lower as Treasury Yields Spike

Stock Market Today: Stocks Reverse Lower as Treasury Yields SpikeA good-news-is-bad-news retail sales report lowered rate-cut expectations and caused government bond yields to surge.

By Karee Venema Last updated

-

Stock Market Today: Nasdaq Leads as Magnificent 7 Stocks Rise

Stock Market Today: Nasdaq Leads as Magnificent 7 Stocks RiseStrength in several mega-cap tech and communication services stocks kept the main indexes higher Thursday.

By Karee Venema Published

-

Stock Market Today: Stocks Tumble After a Hot Inflation Print

Stock Market Today: Stocks Tumble After a Hot Inflation PrintEquities retreated after inflation data called the Fed's rate-cut plans into question.

By Dan Burrows Published

-

Stock Market Today: Stocks End Mixed Ahead of Key Inflation Reading

Stock Market Today: Stocks End Mixed Ahead of Key Inflation ReadingEquities struggled before tomorrow's big Consumer Price Index report.

By Dan Burrows Published

-

Stock Market Today: Stocks Closed Mixed in Choppy Trading

Stock Market Today: Stocks Closed Mixed in Choppy TradingVolatility returned as market participants adjusted their expectations for rate cuts.

By Dan Burrows Published