Your Kids' Tax Brackets Could Lead to Unequal Inheritances

Sometimes, divvying things up equally means one child might end up with less because of tax implications. Here’s how to avoid that.

Estate planning is a critical aspect of comprehensive financial planning, especially when it comes to ensuring your heirs receive the maximum benefit from your legacy. Among the various components of estate planning, the designation of beneficiaries for individual retirement accounts (IRAs) is a particularly nuanced decision with far-reaching tax implications.

The distinction between Roth IRAs and traditional IRAs (or company retirement plans) is crucial to understand when planning for the future of your heirs. Each type of account is subject to different tax rules upon distribution:

- Roth IRAs. These accounts offer tax-free distributions to beneficiaries, which can be particularly advantageous for heirs who are in higher tax brackets.

- Traditional IRAs and retirement plans. Distributions from these pre-tax accounts are taxed according to the beneficiaries' individual tax rates, which means that the actual amount received after taxes can vary significantly among your heirs.

A one-size-fits-all approach in designating equal percentages to each beneficiary may not be the most effective strategy. Instead, a more tailored approach that considers the unique tax brackets of each beneficiary can lead to a more equitable distribution of your estate.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Impact on after-tax inheritance

Consider a scenario where Clara is 80 years old and looking to maximize the amount that goes to her heirs, subsequently reducing the amount claimed by Uncle Sam at tax time. Ray is a prominent attorney in the highest tax bracket of 37%. Steven earns less money and falls in the 12% federal tax bracket.

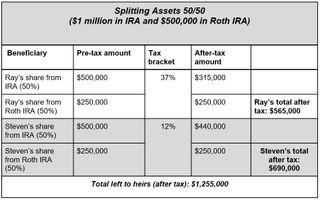

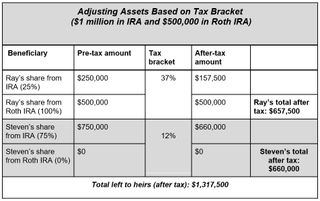

Clara has $1 million in a traditional IRA (pre-tax account) and $500,000 in a Roth IRA. Initially, she had split both accounts 50/50 between her two sons. However, leaving more of the tax-free Roth to Ray may make sense because he is the higher-earning beneficiary. More of the traditional IRA could be left to Steven, as he is in a lower tax bracket, and the taxable distributions from the IRA are less impactful. Consider the following:

By adjusting the amount going to each beneficiary, Clara's distribution was more equitable to each child. She also was able to have less of her inheritance lost to taxes. In fact, she was able to give her heirs a total of $62,500 more ($1,317,500 - 1,255,000) than by splitting each account 50/50.

This also works when considering how much to leave a beneficiary from taxable brokerage accounts. Because of how capital gains are taxed, you may be able to leave your heirs more money by adjusting the amount each beneficiary receives based on their tax bracket.

Tax-efficient estate planning

In essence, strategically designating IRA beneficiaries transcends mere asset distribution; it is a testament to the power of informed financial planning and the profound impact of tax considerations on inheritance. This example illuminates a path for families that can significantly enhance the value of their legacy for their heirs.

By eschewing the traditional equal-split approach in favor of a model that aligns with each beneficiary's unique tax situation, individuals can ensure that their heirs are positioned to receive the maximum possible benefit from their inheritance. This method not only honors the benefactor's intent to provide for their loved ones but does so in a manner that is both tax-efficient and equitable, allowing for a legacy that is felt more deeply and preserved more completely.

The case of Clara and her sons serves as a compelling illustration of how adjusting beneficiary designations to account for different income levels and associated tax brackets can result in a more favorable after-tax outcome. Such strategic adjustments, while requiring careful consideration and possibly the guidance of a certified financial planner, can significantly reduce the tax burden on the estate. This allows a greater portion of one's life savings to reach the intended recipients — fully embodying the true spirit of a given legacy.

Investment advisory services offered through Osaic Advisory Services, LLC (Osaic Advisory), a registered investment advisor. Osaic Advisory is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Advisory.

Related Content

Antwone Harris, MBA, CFP®, is a seasoned financial professional with over 20 years of experience helping clients transition from their main careers to the next phase of their lives. As a former VP-Senior Financial Consultant at Charles Schwab Inc., he managed over $890 million in client assets and ranked in the top 5% of more than 1,100 advisers nationwide. His financial expertise has been featured in major media outlets such as CBS, ABC, NBC, FOX, The Washington Post, Bloomberg, The Financial Times and Kiplinger. Harris is a CERTIFIED FINANCIAL PLANNER™ and a Retirement Income Certified Professional®, focusing his practice on creating comprehensive plans for individuals approaching or already in retirement. Recognizing the anxiety surrounding retirement preparation, Harris founded Platinum Bridge Wealth Strategies to provide specialized financial planning for those nearing or in retirement.

-

Strategies to Optimize Your Social Security Benefits

Strategies to Optimize Your Social Security BenefitsTo maximize what you can collect, it’s crucial to know when you can file, how delaying filing affects your checks and the income limit if you’re still working.

By Jason “JB” Beckett Published

-

Don’t Forget to Update Beneficiaries After a Gray Divorce

Don’t Forget to Update Beneficiaries After a Gray DivorceSome states automatically revoke a former spouse as a beneficiary on some accounts. Waivers can be used, too. Best not to leave it up to your state, though.

By Andrew Hatherley, CDFA®, CRPC® Published

-

Strategies to Optimize Your Social Security Benefits

Strategies to Optimize Your Social Security BenefitsTo maximize what you can collect, it’s crucial to know when you can file, how delaying filing affects your checks and the income limit if you’re still working.

By Jason “JB” Beckett Published

-

Don’t Forget to Update Beneficiaries After a Gray Divorce

Don’t Forget to Update Beneficiaries After a Gray DivorceSome states automatically revoke a former spouse as a beneficiary on some accounts. Waivers can be used, too. Best not to leave it up to your state, though.

By Andrew Hatherley, CDFA®, CRPC® Published

-

What’s the Difference Between a CPA and a Tax Planner?

What’s the Difference Between a CPA and a Tax Planner?CPAs do the important number crunching for tax preparation and filing, but tax planners look at the big picture and come up with tax-saving strategies.

By Joe F. Schmitz Jr., CFP®, ChFC® Published

-

Charitable Remainder Trust: The Stretch IRA Alternative

Charitable Remainder Trust: The Stretch IRA AlternativeThe SECURE Act killed the stretch IRA, but a properly constructed charitable remainder trust can deliver similar benefits, with some caveats.

By Brandon Mather, CFP®, CEPA, ChFEBC® Published

-

Three Ways to Take Control of Your Money During Financial Literacy Month

Three Ways to Take Control of Your Money During Financial Literacy MonthBudgeting, building an emergency fund and taking advantage of a multitude of workplace benefits can get you on track and keep you there.

By Craig Rubino Published

-

How Did O.J. Simpson Avoid Paying the Brown and Goldman Families?

How Did O.J. Simpson Avoid Paying the Brown and Goldman Families?And now that he’s died, will the families of Nicole Brown Simpson and Ron Goldman be able to collect on the 1997 civil judgment?

By John M. Goralka Published

-

What Not to Do if an Employee or Loved One Is Kidnapped

What Not to Do if an Employee or Loved One Is KidnappedBusinesses need to have a crisis plan in place so that everyone knows what to do and how to do it. Sometimes, calling the authorities isn’t recommended.

By H. Dennis Beaver, Esq. Published

-

Why You Shouldn’t Let High Interest Rates Seduce You

Why You Shouldn’t Let High Interest Rates Seduce YouWhile increased interest rates are improving the returns on high-yield savings accounts, that may not be an effective place to park your money for the long term.

By Kelly LaVigne, J.D. Published